Financial services have metamorphosed over time. The surge in mobile payments, personal banking solutions, better credit monitoring, and other financial patterns further ensures that the realm concerning monetary inclusions isn’t what it was a few years back. In 2021, it isn’t just about the ‘Fin’ or Finance but all ‘FinTech’ with disruptive Financial Technologies making their presence felt to change the customer experience, modus operandi for relevant organizations, or the entire fiscal arena to be exact.

FinTech, as a vertical, is data-intensive, with a focus on data mining and Big Data being the technologies that take precedence. But then, implementing, extracting, deploying, and inferring from Big Data repositories isn’t humanely possible with manual and reactive strategies. This is where Artificial Intelligence promptly shows up as a FinTech evangelist, allowing financial firms to explore human-like cognitive abilities, but only on a larger scale.

Table of Contents

How to Set up AI Tools and Techniques for FinTech?

The role of AI in FinTech has been incrementally evolving over the past decade. Also, with the Global AI coverage pertaining to this vertical standing strong at $7.91 Billion, in 2020, the future seems quite promising for financial technology in general.

But that’s not what we are upbeat for! As forecasted, Global AI relevant to FinTech shall witness a massive CAGR surge of 23.17% in the next 5 years with the market valuation expected to hit the $26.67 billion mark by the end of 2026. However, this insane level of growth is only possible if the financial head honchos make AI an organizational commonplace by connecting with relevant firms to procure AI Training data and FinTech datasets for training models via algorithms, patterns, and computational strategies.

If we were to put it plainly, setting up AI for FinTech is all about making the ML and Deep Learning models intelligent enough by feeding them enough data. While this readily hints at AI data collection as one of the primary kickstarters for leading a FinTech charge across the globe, data needs to be backed with labeling, cleaning, and decluttering to make sense to the machines.

But that’s a topic for another day! Right now, we shall focus on the data-driven benefits of AI in FinTech that might look subtle and basic to most but are more than capable of bringing forth a much-anticipated renaissance.

Improved Decision Making

Well, we all want to make the right financial decisions, don’t we! However, cutting through truckloads of misinformation might not be as easy as it seems. However, AI in FinTech is expected to change all that offering insights to the users based on their financial behavior and historical analysis. This functionality or rather use-case taps into data analysis, data science, and visualization to prepare training data from existing banking or finance datasets.

AI can also help banking institutions and lenders make better credit decisions as well by constantly monitoring prospective borrowers and pitching customized lending plans.

Better Security

Intelligent systems meant for monitoring user behavior will be able to analyze past and present patterns to identify financial anomalies. Machine learning algorithms, if and when fed with historical and real-time data can use supervised and unsupervised learning to detect suspicious activity.

With AI in play, FinTech firms can readily scale beyond traditional fraud detection, which is more like an ‘X then Y’ concept. The current crop of tools is based on real-time data and pattern analysis, capable of flagging even the slightest of irregularities, and eventually terminating transactions.

However, the process of fraud detection needs to be fine-tuned by making the models and the subsequent analysis even more accurate. The only way to achieve this is by AI Data Collection and subsequent preparation of AI Training data.

Customer Support

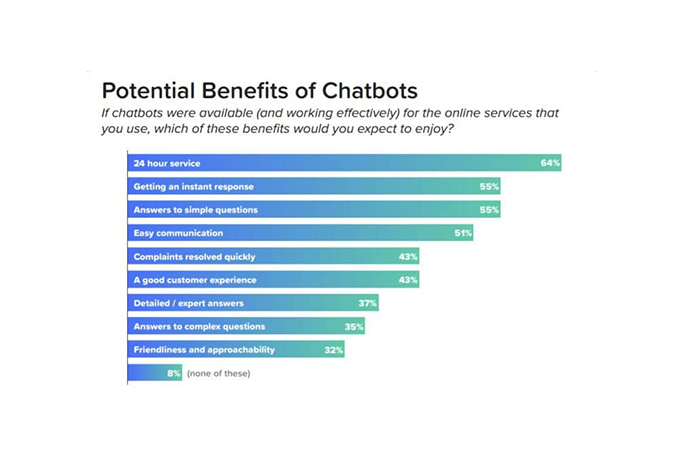

The entire concept of FinTech hinges on customer satisfaction. With AI in the picture, FinTech firms can bring impactful chatbots into the mix, which can organically interact with the customers by producing the right responses. The growth in the number of Robo Advisors is expected to play a major role in the future with organizations planning to focus on NLP, Computer Vision, and Deep Learning inclusions to make the chatbots more responsive.

Source: aimultiple.com

Predictive Analytics

This use case is all about collecting gargantuan volumes of data from the users, processing it using relevant setups to find patterns, and eventually predicting actions. This approach focuses on data mining and deep learning as associative technologies, allowing companies to empower virtual agents and risk management resources, improve client analytics, and even be of assistance to the sales team when it comes to planning new target campaigns.

Automation

The inclusion of AI can readily speed up several back-office tasks and mundane operational processes, thereby helping financial institutions save money and focus on bringing in company-wide automation.

Better Trading

Certain stocks and Crypto-focused trading platforms have already been made more powerful, proactive, and perceptive. These platforms focus on churning humongous volumes of datasets to come up with targeted investment recommendations for the users. Also, the intelligent models focused on trading use time-series analysis to prepare algorithmic trading setups, with built-in support for risk management and hedging.

Bottom-Line

Just to be clear, we simply scratched the surface while discussing the relevance of AI and Machine learning in FinTech. While the possibilities extend way beyond the ones mentioned during the course of this discussion, these pointers are good enough to at least analyze the basic impact of predictive, supervised, and proactive technologies on FinTech as a domain.

Organizations, who are looking forward to developing targeted FinTech tools, relevant to any of the aforementioned use cases must rely on service providers like Shaip to prepare AI Training data for the most accurate outcomes. However, transitioning to an AI-powered setup at once can be a tad overwhelming for businesses and users, which for now calls for combined machinery with AI elements and classic financial techniques complementing each other.